After decades of declining and ultra-low interest rates, the velocity and magnitude of global rate rises, and tightening credit conditions have dominated the investment landscape.

A direct by-product of the steepness and severity of the monetary tightening cycle, the regional banking turmoil in the US in early 2023 served as a timely reminder of the importance of managing financial risk.

Private credit offers investors the potential to preserve capital and generate resilient and regular income. It provides an opportunity to lend against high-quality assets with equity-like return characteristics, has low correlation to other asset classes and is a compelling and defensive floating-rate option to cope with the future (however that plays out).

What is behind the rise of private credit, why is it a good time to invest and what role can it play in optimising portfolio allocation?

The rise of private credit

Structural shifts in regulatory capital requirements have forced banks to be less active in certain segments of both the corporate and real estate lending market.1 This has supported the rise of private credit investment solutions.

Major regulatory changes occurred at the same time as institutional investors increased their exposure to private markets more generally in search of income yield in the prevailing ultra-low interest rate environment of the time.

The profound sustained and fundamental changes to the investment landscape is motivating investors of all types to reconsider how to protect and growth wealth and diversify outside the traditional public equity and debt markets.

The historical rules dictating asset allocation no longer necessarily prevail. Surges in 10-year bond yields and the UK gilt crisis in late 2022 led to a re-assessment of the role of public market debt in providing capital protection.2 The US banking crisis in early 2023 added a new layer of opportunity for non-bank lenders.

No longer supported by a low interest rate regime, private credit market investing offers an increasingly attractive alternative to public assets (where price and valuation are increasingly dictated by market sentiment and momentum).

With the suite of private market alternatives expanding (including private credit funds) there are increasing investment opportunities, not just for institutional investors but a wide range of investor groups including high net worth and retail investors.

Floating rate credit is well suited to current conditions

Conditions for floating rate private credit are the best they have been for a generation.

With higher interest rates, private credit benefits from the upward movement of rates occurring at the same time as the regulatory environment exerts pressure on traditional banks to secure their balance sheets.

In the hands of an experienced manager with multi-cycle experience, the position of private debt in the capital structure and its floating rate nature operates to reduce income volatility and downside risk.

Investors should choose an asset manager carefully, based on the scale and depth of their platform, the depth of embedded governance, the experience of the lending team, and an established track record through multiple cycles.

The opportunity in private credit. Challenges remain for publicly traded assets

Long-term investors have faced two major shifts in the investment environment.

One has been steadily building (the rise of private assets to the core of investment portfolios) while the other materialised relatively quickly (rising interest rates and a prolonged period of macro uncertainty).

Both require a fundamental re-think of the asset allocation process.3 The benchmark portfolio (60% equities, 40% fixed interest) took a significant hit during 2022 heralding a paradigm shift in capital allocation to a more defensive position. Private credit is set to expand its reach to occupy a greater proportion of the capital structure, and a higher allocation within investor portfolios.

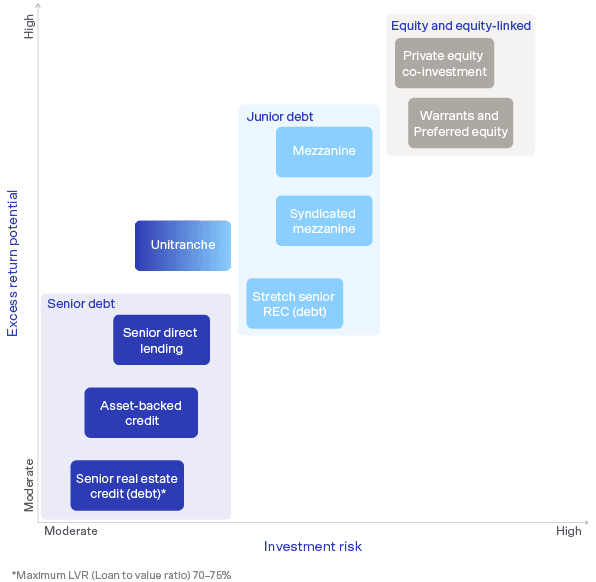

Risk/Return profile for private credit

For more information about our private credit solutions, please get in touch.

1 The New Dynamics of Private Markets, Winter 2022, PGIM, www.pgim.com

2 Three US banks failed in March 2023, triggering a swift response by regulators. Source: The Evolving Nature of Banking, Bank Culture, and Bank Runs. Speech by US Federal Reserve Governor Michelle Bowman, 12 May 2023, www.federalreserve.gov

3 MSCI, Building Balanced Portfolios for the Long Run, October 2022, www.msci.com

Important Information: This material has been prepared by MA Investment Management Ltd (ACN 142 008 535) AFS Representative Number 001258449 (MA Asset Management). The material is for general information purposes and must not be construed as investment advice. This material does not constitute an offer or inducement to engage in an investment activity nor does it form part of any offer or invitation to purchase, sell or subscribe for in interests in any type of investment product or service. This material does not take into account your investment objectives, financial situation or particular needs. You should read and consider any relevant offer documentation applicable to any investment product or service and consider obtaining professional investment advice tailored to your specific circumstances before making any investment decision. Any investment in a fund managed by MA Financial Group is subject to the terms and conditions of the relevant fund offer document. This material and the information contained within it may not be reproduced or disclosed, in whole or in part, without the prior written consent of MA Asset Management. Any trademarks, logos, and service marks contained herein may be the registered and unregistered trademarks of their respective owners.

Nothing contained herein should be construed as granting by implication, or otherwise, any licence or right to use any trademark displayed without the written permission of the owner. Statements contained in this material that are not historical facts are based on current expectations, estimates, projections, opinions and beliefs of MA Asset Management. Such statements involve known and unknown risks, uncertainties and other factors, and undue reliance should not be placed thereon. Additionally, this material may contain “forward-looking statements”. Actual events or results or the actual performance of MA Asset Management services may differ materially from those reflected or contemplated in such forward-looking statements. Certain economic, market or company information contained herein has been obtained from published sources prepared by third parties. While such sources are believed to be reliable, neither MA Asset Management, MA Financial Group or any of its respective officers or employees assumes any responsibility for the accuracy or completeness of such information. No person, including MA Asset Management and MA Financial Group, has any responsibility to update any of the information provided in this material.